40+ Fha to conventional refinance calculator

An FHA streamline refinance is a type of rate and term refinance option. Pay off the mortgage in full stops when paid off.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

See all Mortgage Learning Center.

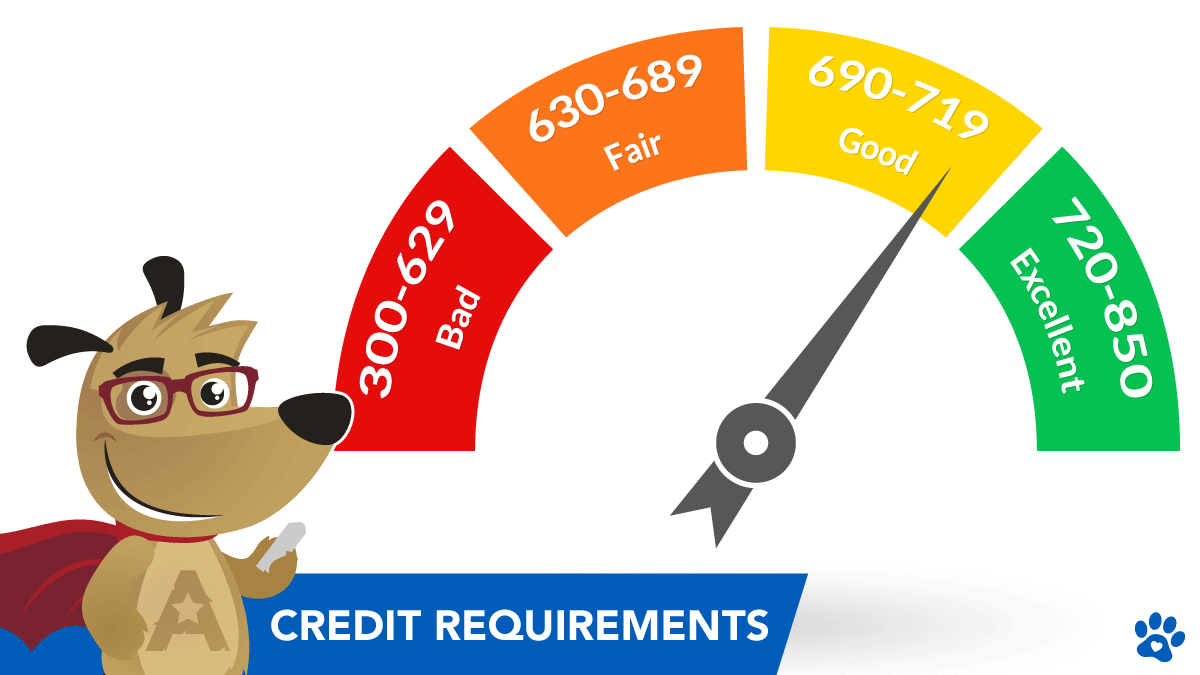

. According to FHA guidelines applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance. The MoneyGeek calculator allows you to run cost of living comparisons of expenses in nearly 500 US. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate.

How much do I need to make to afford a 200000 house. Over 40 cheaper than FHA. FHA loans have low interest rates.

To build it MoneyGeek combined data from the Council for Community and Economic Researchs Cost of Living Index employment data from the US. Minimum down payment. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

Dont miss out on the latest low rates huge potential savings. The FHA Streamline Refinance is a quick and easy way to lower your FHA mortgage rate and monthly payment. Is Earnest Money Part of the Down Payment.

Your FHA mortgage should also be at least 210 days active before you refinance. They allow borrowers to have 3 more front-end debt and 7 more back-end debt. The third tab shows current Redmond mortgage rates to help you estimate payments and find a local lender.

Loans backed by the FHA may be an affordable alternative to a 40-year home loan. Find The Right Mortgage For You. Or want to refinance your existing conventional or FHA mortgage the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.

Just like FHA USDA PMI annual fee continues for the life of the loan. See todays 30-year mortgage rates. Depending on the loan amount and interest rate.

Here are a few benefits you can enjoy with an FHA loan. For a borrower putting down 3 on a conventional loan comparable to the 35 minimum down payment on an FHA loan the APR would look a lot closer to the APR for an FHA mortgage. FHA loans also require 175 upfront premiums.

Borrowers must have a property appraisal from a FHA-approved appraiser. To afford a 200K mortgage with a 20 down payment 30-year term and 4 interest rate youd need to make at least 38268 a year before taxes. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

You should also look at. Loans through the FHA are insured by the agency so lenders are more lenient. A 30-year conventional loan.

How FHA loans work. While FHA loans only require a 35 down payment this is still slightly higher than the 3 down payment requirement for a 30-year. Borrowers front-end ratio mortgage payment plus HOA fees property taxes mortgage insurance homeowners insurance needs to be less than 31 percent of their gross income typically.

The loan is secured on the borrowers property through a process. Ad Work with One of Our Specialists to Save You More Money Today. For homeowners with FHA loans issued on or after June 3 2013 you must refinance into a conventional loan and have a current loantovalue ratio of 80 or lower.

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Earnest Money vs Down Payment. Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores the FHA makes loans available with lower requirements so its easier for you to qualify.

Ad Compare A Range Of Mortgages Online. Ad Take our Free 30-Second Assessment find out how much you could save by refinancing. You may be able to get approved with as high a percentage as 40 percent.

Conventional PMI vs FHA mortgage insurance. Because there is only one US. Its not surprising that mortgage rates are climbing Danielle Hale chief.

Select the Funding Fee Select fee 000 050 100 125 140 165 230 360. Borrow 90 or less on an FHA refinance 11-year cancellation. ARM conventional and jumbo mortgages FHA.

FHA loans have more lax debt-to-income controls than conventional loans. 30 to 40 days for purchase closings the lender says it will make an. Yet the amount does decrease each year.

Conventional mortgage loans do not require government mortgage insurance premiums MIP but they do require private mortgage insurance or PMI. 580 Maximum debt-to-income ratio. Refinance to a conventional loan under 80 No PMI once closed on a new loan.

The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates. Loan-to-value ratio LTV is. A guide to better understanding closing.

Bureau of Labor Statistics and demographic data from the US. Unless you put 20 percent down or refinance with at least 20 percent in home equity your conventional lender will likely require PMI. 580 Credit Score - and only - 35 Down.

35 Minimum credit score. If you currently have one or more VA loans and looking to refinance one of them use this calculator to see if you will need a down payment or if your sufficient equity. The average interest rate for a 30-year mortgage has broken 6 for the first time since 2008 at 602 last week.

15-Year Vs 30-Year Mortgage Calculator Mortgage Refinance Calculator. To qualify your mortgage must be current meaning you should have made the last 6 months of payments on your loan. Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan.

Qualifying for a conventional mortgage requires a higher credit score solid income and a down. This only allows you to obtain a lower rate change your term or both. Most FHA insured lenders however set their own limits higher to include a minimum score of 600 - 620 since cash-out refinancing is more carefully approved than even a home purchase.

The reason that FHA loans can be offered to riskier clients is the required upfront payment of mortgage insurance premiums. Unlike FHA loans conventional loans are not insured by the government. You might be able to refinance to a 40-year mortgage depending on what your lender offers.

FHA loans are great for first-time buyers or people without sterling credit or much money. Some banks and mortgage lenders provide 40-year loan. Down payment requirement is not as low as conventional loans.

Houston Fha Down Payment Assistance Programs In 2021 Texas United Mortgage

5 Common Home Contingencies When House Hunting

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Fico Myths

How To Calculate Mortgage Payment In Microsoft Excel Quora

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

Credit Requirements For A Reverse Mortgage Loan

Manufactured Home Loans Santiago Financial Inc

Fha Loan Complete Guide On Fha Loan With Its Working And Types

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

What Is Escrow And How Does It Work Texas United Mortgage

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

Colorado Mortgage Loan Officer Get Preapproved Today

1 Lakewood Mortgage Broker Nathan Mortgage

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

7 Big First Time Buyer Mistakes To Avoid When Purchasing A Home In Texas